In recent years, Ghana has witnessed a surge in affordable housing projects, a promising endeavor aimed at providing decent shelter to its citizens. However, a closer look at the price tags attached to these so-called “affordable houses” reveals a stark reality – what should be accessible to the masses often remains out of reach due to exorbitant prices quoted in dollars. In this article, we are going to talk about the concept of affordable housing in Ghana, analyze its true affordability for the average citizen, and examine whether these initiatives are genuinely intended to serve the people or if they’re just another means of financial gain for the government.

The Mirage of Affordability of “Affordable Housing” in Ghana

The Ghanaian government has launched various affordable housing projects across the country, touting them as solutions to the housing crisis. These projects, often in partnership with private developers, promise modern amenities, security, and a better quality of life. However, the term “affordable” seems to be a misnomer, as the prices attached to these houses are far from reasonable for the average Ghanaian.

The Affordability Gap:

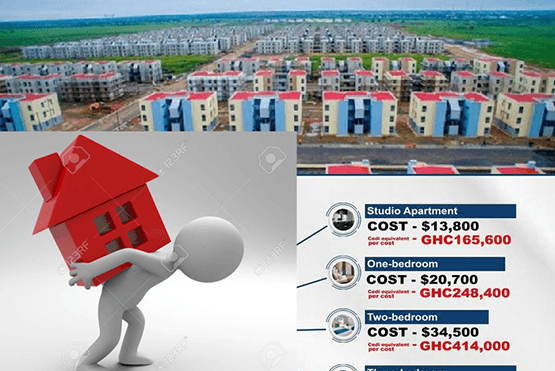

To gauge the true affordability of these housing projects, it’s essential to consider the income levels of the average Ghanaian. According to the Ghana Statistical Service, as of 2021, the average monthly income in Ghana was around GHS 2,000 (approximately $350). To put this in perspective, let’s take a look at some of the prices quoted for these “affordable” houses:

-

Example A:

A two-bedroom house in a government-affiliated affordable housing project is priced at $50,000. At the prevailing exchange rate, this translates to around GHS 285,000. For an individual earning the average monthly income, saving up for such a house could take over 11 years – assuming they save their entire income and don’t account for inflation.

-

Example B:

Another project offers a three-bedroom unit at $80,000, equivalent to roughly GHS 456,000. This means a person earning the average monthly income would need more than 19 years of saving without spending a single cedi to afford this house.

The Voice of the Citizens:

Amid the rising concerns over the true affordability of these housing projects, many citizens have voiced their frustrations. Prominent individuals and civil society organizations have questioned the logic behind labeling these houses as “affordable.” These critics argue that the government’s definition of affordability does not align with the economic realities faced by most Ghanaians.

Final Thoughts:

The concept of “affordable housing” in Ghana seems to be wrapped in paradox. While the government’s initiatives to provide decent housing to its citizens are commendable, the execution often falls short of the promise. The exorbitant prices, quoted in dollars and detached from the economic realities of the average Ghanaian, raise questions about the true intentions behind these projects. Are they genuinely designed to uplift the citizens, or do they serve as lucrative ventures for the government?

As Ghana strives to bridge the housing gap and improve the lives of its citizens, recalibrating the definition of affordability based on actual income levels is imperative. It’s time to reevaluate the housing initiatives, ensuring that they align with the financial capabilities of the people they aim to serve. Only then can Ghana move closer to achieving truly affordable housing for all its citizens.