Rampant development and soaring property prices are causing families to pack up and leave the city

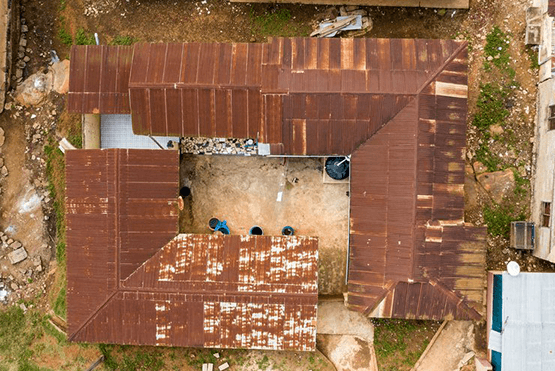

Cecilia Nyametse, a janitor, has been squatting in a security office on a construction site in Cantonments, a plush suburb of Ghana’s capital, Accra, for nine months because, like thousands of other people, the rising cost of living means she can’t afford the sky-high rents in the city.

This situation is not limited to those on low incomes. Isaac Ansah-Addo, a doctor with three children and a wife, said he moved from Accra to Kasoa – an area on the outskirts of the city with a high crime rate and prostitution – three years ago because the rent was getting too high.

Ansah-Addo, 45, was paying two years’ rent up front, to the tune of $3,360 (GHC39,950), for a three-bedroom house in Spintex, a suburb of Accra. The GP, who earns $500 (GHS6000) a month, said moving out of the city was a difficult decision but has been cost-effective.

“The killer rent was gradually running my pocket dry and at a point, I was depleting the family savings just to have accommodation in Accra,” he told openDemocracy. “I have [my kids] school fees to pay, not to talk of the daily family upkeep and utility bills. So, moving to Kasoa was a sound financial decision but comes at a cost security-wise. I now pay $95 a month for the same number of bedrooms.”

Cecilia Nyametse, a janitor, has been squatting in a security office on a construction site in Cantonments, a plush suburb of Ghana’s capital, Accra, for nine months because, like thousands of other people, the rising cost of living means she can’t afford the sky-high rents in the city.

This situation is not limited to those on low incomes. Isaac Ansah-Addo, a doctor with three children and a wife, said he moved from Accra to Kasoa – an area on the outskirts of the city with a high crime rate and prostitution – three years ago because the rent was getting too high.

Ansah-Addo, 45, was paying two years’ rent up front, to the tune of $3,360 (GHC39,950), for a three-bedroom house in Spintex, a suburb of Accra. The GP, who earns $500 (GHS6000) a month, said moving out of the city was a difficult decision but has been cost-effective.

“The killer rent was gradually running my pocket dry and at a point, I was depleting the family savings just to have accommodation in Accra,” he told openDemocracy. “I have [my kids] school fees to pay, not to talk of the daily family upkeep and utility bills. So, moving to Kasoa was a sound financial decision but comes at a cost security-wise. I now pay $95 a month for the same number of bedrooms.”

Ghana’s real estate sector has experienced significant growth in recent years, fueled by increasing urbanization and a growing middle class. However, this rapid expansion has also led to soaring property prices, making homeownership increasingly unaffordable. A one-bedroom house is now on average more than $100,000 and as high as $1m, according to online marketplace meqasa.com.

Another problem is that landlords and property owners often demand a year’s rent in advance, even though rent laws state the limit is six months. The limited supply of housing leads property owners to openly flout the laws and the state-owned Rent Control Department – the regulator of the sector – has been largely ineffective in stopping it. Its spokesperson Emmanuel Kporsu told openDemocracy they have “logistical challenges and that makes it difficult to monitor the rental market effectively”, adding that tenants who feel cheated can always lodge complaints at any of their district offices.

Successive governments have also failed to roll out affordable housing projects. But now, as part of plans to support low-income earners to afford the advance rent payment, the government has rolled out a scheme to provide rent loans to Ghanaians. Under the National Rental Assistance Scheme, which is targeted at those with regular incomes, people find a place based on their income level and the government pays the hefty advance directly to the landlord. The tenant then pays this back in monthly installments.

“We’re weighing other options but for now we’re testing this scheme as one of the key interventions by the government to provide low- to middle-income earners with a mechanism to pay low monthly rent,” housing minister Francis Asenso-Boakye told openDemocracy.

Divine Aggor, CEO of the Rentchamber Group, which advocates for innovative housing solutions, told openDemocracy that as it stands people are “forced to go and rent in peri-urban areas like Kasoa, Aburi, and Dodowa and trek daily to work in Accra”.

Without a functioning regulatory body, it becomes difficult to protect the rights of both buyers and sellers, leading to ‘exploitation’, Aggor added.

Nyametse, 30, said she used to live in the middle-income area of Osu Ako-Adjei in Accra, where she was paying GHS300 (US$25) a month for a single room with a shared bathroom and toilet, up from US$12 a month two years ago.

But her landlord served her and the other tenants with an eviction notice in February this year before leasing the house three months later to a commercial property services company.

“My landlord said he needed more money so he rented the property out to be used as an office space. I have not been able to rent again because the minimum I come across is GHS500 a month [more than a month’s pay for someone on minimum wage]. The lowest I get is GHS250 (US$21), which is also far away from where I work, so I have no option [but to squat],” Nyametse told openDemocracy.

She is not alone. Cosmopolitan Accra is home to many who come in search of jobs, particularly from the north of Ghana. Most of them end up occupying uncompleted buildings as a result of the steep rents. According to Ghana’s National Development Planning Commission, squatter settlements and slums house about 58% of Ghana’s urban population, with an expected growth rate of 1.8% each year.

Meanwhile, the burgeoning real estate market has become a money spinner for private landlords, who are selling their properties to commercial firms, such as Broll Ghana, who run them as offices and luxury apartments.

Broll Ghana’s latest research reveals there are now around 85,000 property transactions each year, encompassing both sales and rents, and states the majority of Ghanaians can’t afford the prices of new builds, which are usually sold for more than $100,000.

High demand for upscale apartment towers

So who is buying them? The African diaspora and investors, according to experts, say the demand for luxury apartment blocks and townhouses – especially in major cities – is rising. As a result, homes are being bulldozed to make way for luxury flats and office blocks.

Some of those moving to Ghana from elsewhere on the continent are also settling in the mountainous regions such as Aburi and Akwamufie – a 74km drive away from Accra.

The Coalition of La Associations (COLA), a collective of youth groups representing a section of the traditional authorities in coastal Accra, has long protested against the government for allegedly giving out leased lands from the chiefs to private developers.

“Our interest is to protect what belongs to us else we’ll one day wake up and realize that the city has been taken over by non-indigenes,” COLA spokesperson Jeffrey Tetteh told openDemocracy. “We are not against development, but the government must make sure that the interests of the locals are protected.”

He added: “Transparency is key. If the government does not find any use for the lands it leased from our forebears decades ago, it is only fair they return them to the traditional leaders, rather than giving them out to private developers without consulting us.”

Despite Ghana’s housing deficit of over two million units, a rising cost of living has also left homes and office blocks in Accra empty, especially in prime areas such as Labone, Cantonments, East Legon, North and Roman Ridge, Osu, Kanda, and Airport Residential Area.

“House to let” or “Office space to rent” signs are common, and many have been vacant for well over a year.

“The lower- to middle-income earners are being priced out of the housing market and within the next ten or 15 years if care is not taken all the developments you see will become ghost towns,” Aggor said.

The luxury apartments and penthouses in these locations come with access to green spaces, pools, gyms, clubhouses, security, and maintenance.

They are also marketed and sold in US dollars.

“They [African diaspora] have the purchasing power and charging in US dollars makes it easier for them to relate,” Michael Adusei, a marketing executive with Dream World Apartments, told openDemocracy.

But there is growing concern among a section of Ghanaians about the listing of rents in dollars, which is in clear violation of Ghana’s fiscal laws. The Bank of Ghana, the regulator, did not respond to openDemocracy’s request for an interview. However, it has previously cautioned “the general public to desist from pricing, advertising, receiving or making payments for goods and services in foreign currency.”

The Ghana Union of Traders Association (GUTA), the umbrella body that regulates the activities of trades in Ghana, has fought the dollarisation of the economy and its president Joseph Obeng told openDemocracy it weakens the local market.

“We have spoken against benchmarking prices on the dollar,” Obeng said, adding: “This must stop because high demand for the dollar causes depreciation of the cedi. We must see action from both the government and the central bank.”

Using US dollars as a medium of exchange in the real estate sector has dire implications on the economy, according to economist Gertrude Sey.

“It really has to be checked and I blame the Bank of Ghana for doing little to control it,” she said. “It is one of the causes of the exchange rate depreciation, which eventually affects inflation. It also creates a liquidity shortage.”

However, the Ghana Real Estate Developers Association (GREDA), the umbrella body of property developers, said its clients are left with no choice but to serve a niche, elite clientele who can purchase in foreign currency because the sector faces price volatility as a result of inflation and the exchange rate.

Spokesperson Samuel Adjiri said. “It’s a stop-gap measure to ensure that what we invest in does not just disappear because of fluctuation.”

The 2022 Voluntary National Review on the UN’s Sustainable Development Goals found that 8.8 million Ghanaians were living in shanty towns in 2020, an increase from 5.5 million in 2017.

“There is no future for the typical Ghanaian when it comes to housing. No one has the interest of the ordinary person at heart and that is really worrying,” Aggor said.

Environmentalists are also raising red flags over the effects and the pressures mass development puts on the ecological and social systems.

“We’re losing a lot of our green spaces in Accra as a result of these rapid constructions and that could lead to a major catastrophe, such as flooding,” Adeladza Kofi Amegah, an environmental health expert with the University of Cape Coast, told openDemocracy.

“We must adopt a national policy to protect the green covers.”

Credit: OpenDemocracy