Property Rates(also popularly called Property Taxes) in Ghana, are taxes paid on properties on annual basis. This tax is collected and administered by the Metropolitan, Municipal and District Assemblies (MMDAs). However, it is vital to note that Rent Taxes, on the other hand, are collected by the Ghana Revenue Authority (GRA).

Property tax is levied annually on the estimated value of the property, depending on the classification of the area where the property is located. Previous rates ranged from 0.5% to 3%. These rates were by far, the highest rates paid on properties in the capital, Accra in comparison with other regions of Ghana.

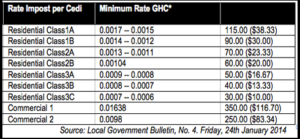

The best way to know how much property tax will be levied on one’s property is to know his or her rating zone or residential class. The AMA (Accra Metropolitan Assembly) announced new rates at a general meeting of the Assembly on 31st October 2013 and published in the Local Government Bulletin, No.4, of 24th January 2014.

Below are rating zones of the Accra Metropolitan Assembly:

- Residential Class 1A:

- Achimota Forest Residential, Roman Ridge, Airport West, East Legon, Ambassadorial Enclave, Ridge.

- Residential Class 1B:

- Zoti, Abelenkpe, Dworwulu, North Dworwulu, East Legon Extention, West Legon, Ringway Estates, Nyaniba Tesano-1.

- Residential Class 2A:

- South Odorkor, DansomanSSNIT, Addogon, New Dansoman Estates, Latebiokorshie, Candle Factory, Mamprobi, Kanda Estates, Dansoman Estates, NimaAkuffoAddo, Asylum Down, Naaflajo, GREDA Estates, New Achimota.

- Residential Class2B:

- Kwashieman North, Sakaman-Busia, Abofu New Dansoman, Mataheko, OsofoDadzie, West AbboseyOkai, Dansoman Sahara, North Alajo, Adabraka, Tesano-2, Kaneshie, Borabora Estates, Awudome Estates, North Kaneshie, Abeka, Fadama, Apenkwa, North Kaneshie Estates–CFC, Akweteman.

- Residential Class 3A:

- Kwashibu, Kwashiman, North Odorkor, Odorkor Old Town, Kwashieman Old Town, Odorkor, Stanley Owusu, Banana Inn, KorleGonno, MamprobiSempey, Maamobi, Old Dansoman, Kotobabi Police Station, Kpehe, Alajo, Kotobabi, James Town, Manhean, Alogboshie, AbekaLapaz, Bubiashie/New Fadama, Kisseman/Christian Village.

- Residential Class 3B:

- AbosseyOkai, Sukura, Russia, Sabon Zongo, Town Council Line, Mamponse, Tunga, Nima, Accra New-Town, Shiashie Village, Darkuman, Bawleshie Mempeasem, Anumle, North Abeka, Old Bubiashie, NiiBoyeman/Achimota.

- Residential Class 3C:

- Chorkor ,Mpoase, Gbegbeise, Shiabu, Luga, Osu Amanfo/Alata.

- Commercial Class 1:

- CBD and Extended CBD

- Commercial Class 2:

- Extended Central Business District including Tudu, Osu Amantra, Osu Anorho, CDC, Kuku Hill, Airport West, Switch Back Road, Roman Ridge, Airport By-Pass, Police Quarters, and DVLA.

A conscious review of the above categorization indicates that property tax is dependent as much on the location as on the value of the property. Commercial class property pays the most tax whilst tax payers in the residential class 3C contribute the least. With the checkered nature of the issuance of property tax, government revenue services are often the brunt of the complaints of many dissatisfied Ghanaians who are of the view that they have been over-billed, just by virtue of their location.

Ratings in Accra are far higher compared to the other nine regions of Ghana and thus, it would be advisable to inquire from tax authorities in these regions or you can use the Greater Region property tax rate as your baseline.

Credit: Ghanahouseplans.com

Join The Discussion